There is no denying pets play an important part of our lives – they are family after all. Many pet owners will do whatever they can to improve – or at least maintain – their pets’ health. Because of this dedication, it is in your best interest to accept all payment methods to make the owners’ decision that much easier, but there are some innovative payment alternatives that may help you increase your revenue.

Of course there are the six most common payment types business owners can accept. But, there is an ongoing debate about the following alternative payment methods in the veterinarian world, with one vet-and-pet-owner payment friendly option to consider above all else.

Insurance

Insurance is undoubtedly a payment option your practice might encounter – and might even consider offering.

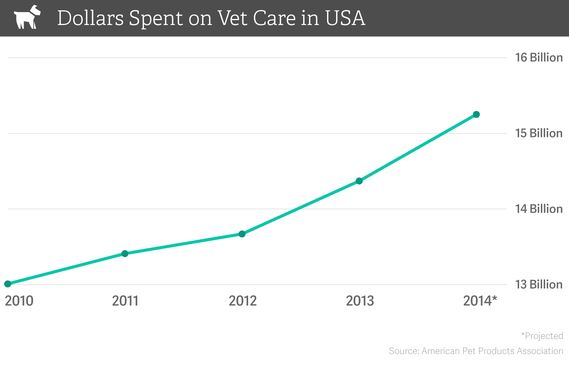

It’s an up-and-coming business. Veterinarian care expenditures have been rising consistently since 2010, topping out in 2014 at nearly $16 billion:

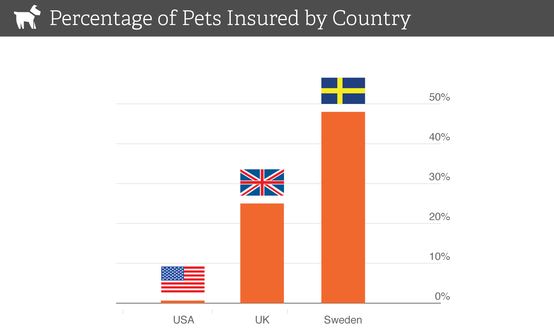

But here’s the kicker: pet owners also spent $870 million on pet insurance – even though, shockingly, 99% of America’s pets are uninsured:

There are simple reasons why: insurance providers often require pet owners pay high deductibles, many have exclusions, and many pet breeds may not even be covered due to pre-existing conditions. Plus, some providers will not cover general office visits.

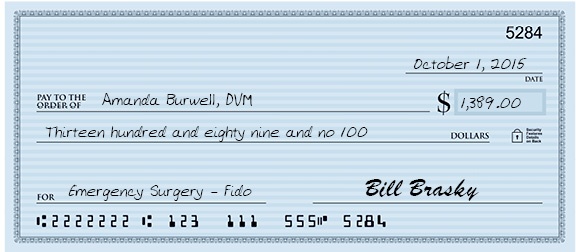

For those pet owners that pass on insurance and are then faced with a pet health crisis, most are forced to pay out of pocket – or with some sort of credit.

VET-RDC Mitigates Risk - Saves Time & Increases Sales

Download Free Guide Here

Credit

You may know Care Credit. Care Credit can help owners pay for many procedures, including annual check-ups, spay and neutering, medication, and vaccinations.

But it’s just a credit card. And when you accept credit cards you pay high merchant fees – sometimes as much as 4% of the total, which can significantly impact profits. In fact, a number of New York state veterinary clinics have refused to process payments through the service due to the fees.

Some of your owners might want to pay with their smartphone. PayPal processed $46 billion in mobile payments in 2014, Google Wallet has around 20 million downloads and Apple Pay is now accepted at 700,000 locations.

Given the trillions of transactions that happen every year, that’s actually a pretty low adoption rate. While 74% of American smartphone users are aware their phones can be used as payment devices, only 16% have made a mobile payment. And while there are plenty of mobile point of sale solutions on the market, most require NFC-equipped hardware, and so far only about 100,000 NFC outlets exist in the United States. And when you look at the top five Apple Pay retailers, three are fast food and the other two are Whole Foods and Walgreens -- low ticket, repeat-visit businesses quite unlike veterinary clinics.

Consumers are worried about the security and privacy of mobile wallets. The Wharton School of Business found that “…most consumers would be willing to use mobile wallets only if at least 75% of retailers, hospitals and other relevant entities accepted them.”

Since this is not the case, many pet owners may fall back on payment types they are comfortable with, i.e. checks.

You can use that tendency to close business. Veterinarians are compassionate by nature and dedicated to improve and maintain pets’ health. Since proper treatment often comes with expensive bills, don’t put yourself in the tough situation of having to tell a pet owner with no insurance or credit that there is nothing you can do – when there could be.

Veterinarians Remote Deposit Capture (VET-RDC) offers the risk mitigation of check guarantee, saves time and money with RDC by avoiding visits to the bank, and increases sales with the Multiple Check payment option.

The Multiple Check component allows you to set up a payment schedule with the pet owner, but it’s not financing and doesn’t require a credit check (as would the GE Care Credit card). The revenue to you is fully guaranteed, so you can provide flexibility for pet owners without taking on risk yourself.

Do yourself and your pet owners a favor: consider VET-RDC for your business. No limitations, exclusions, or pre-existing conditions to worry about.

Get the full details in this free guide.