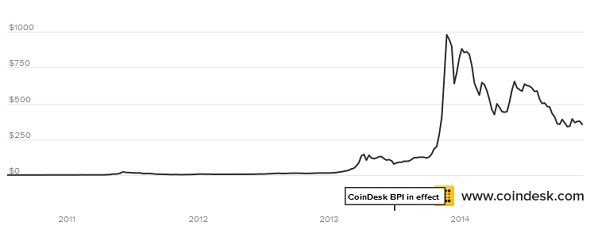

Bitcoin Value in U.S. Dollars at Time of Publishing (12/16/14)

Everyone’s heard of Bitcoin and everyone suspects that it’s cool – but is it cool in the way that smoking is cool, or is it cool in the way that new clothes are cool?

After all, the whole point behind the digital currency is to create something independent of governments and central banks, and to create a way that people can make payments as anonymously as cash, which gives it something of an outlaw aroma.

Then again, in a free world where every type of border dissolves in the internet, why should governments and central banks be the only ones who can create money? Bitcoin also has some sort of fashion caché.

So What Is It?

Perhaps the most interesting thing about Bitcoin is the way it’s made.

Since it’s purely digital, it begins with software. The software underlying the entire Bitcoin environment is completely open-source, which means that you and everyone else can read the source code that makes the software work on a computer. This actually makes it far more secure, because everyone involved knows exactly how the system works.

It also means that there is no central authority overseeing Bitcoin. From one end to the other, the whole thing is an enormous global collaboration of developers and users.

In order for it to work, everything in the Bitcoin environment must be encrypted. Heavily encrypted, in fact – to such a degree that it takes a massive amount of computing power just to handle the encryption.

In 2009, when the Bitcoin was introduced, people with ordinary computers were given extraordinarily difficult mathematical problems to solve with the open-source software. The answers to these problems provided the encryption needed to make the system secure.

These people were also required to approve transactions taking place between Bitcoin users, assuring that they were accurate and legitimate. They had no idea who was transacting business or why; their only role was to protect the integrity of the system.

The Bitcoin network automatically makes the math problems more difficult depending on the rate at which they are solved. Pretty soon ordinary computers couldn’t handle them, so people switched to using video game processors, which were better at this type of math.

It was around then that the amount of electricity required to run the machines started eating into a problem solver’s profits. An industry sprang up to provide computer processors that were specifically designed to solve the ever-more-difficult problems. Today, they require so much computing power that people form groups to work on them collectively.

And how would you pay people to provide computing power and to authorize transactions?

With Bitcoin, of course, and this is how new Bitcoin comes into circulation. Ever so coolly, this is not considered “earning” Bitcoin – it’s called “mining” it.

Today there are about twelve million Bitcoin in circulation, and the current system is designed to allow for twenty-one million overall.

What’s It Worth?

For the first few years no one wanted to buy your Bitcoin so it was “worth” nothing in terms of dollars.

However, from the very start online merchants – especially drug dealers and others attracted to the system’s anonymity – would accept Bitcoin as payment. Bitcoin circulated among these merchants and their customers until 2013, when demand for anonymous cash-like online transactions started to increase due to fear of such things as government surveillance and the constantly compromised security of credit and debit card payments.

As you can see below, in late 2013 Bitcoin hit the mainstream. It burst into the public imagination as a possibly brilliant alternative to currencies backed by states. In the same way a piece of paper backed by the U.S. Government has value globally, suddenly Bitcoin, backed only by an international collective maintaining a secure system, also had value.

Now there were Bitcoin buyers everywhere, and since only a limited number of Bitcoin existed, demand outstripped supply and drove up its value.

But what’s really interesting is what happened after the spike. Unlike bubbles in the past – most famously the 1999 internet bubble, when an overheated market valued some companies that had no revenue in the hundreds of millions only to see them vanish into thin air – Bitcoin retained a significantly higher value even after its bubble deflated.

Even more importantly, the currency survived a series of crisis that arose because of this intense new interest. The worst one was the collapse of Mt. Gox, a Japan-based Bitcoin exchange run by a 29-year-old Frenchman, Mark Karpelès. Claiming that “technical issues” allowed for fraudulent withdrawals from the exchange, in February the company acknowledged that it had lost 750,000 of its customers’ Bitcoins, along with about 100,000 of their own.

One would think that such a disaster would have placed Bitcoin in the same security-compromised category as credit and debit cards, but it didn’t.

In fact, for some investors it had the opposite impact. Venture capitalist Tim Draper of Draper Fisher Jurvetson thought the currency’s resilience to this crisis proved that demand for it and the payment methods it enabled are here to stay. Draper told The Wall Street Journal, “[Bitcoin] is so important to people that they were willing to put up with that.”

When the U.S. Federal government held an auction for 30,000 Bitcoin, Draper won it, and he plans to bid on the government’s next auction for 50,000.

(And how did the government end up with all that Bitcoin? Well, when the FBI arrested Dread Pirate Roberts, the mastermind behind a theoretically untraceable drug and illicit goods bazaar known as Silk Road, they grabbed his arms first while another officer whisked away his laptop. As anticipated, he was logged into everything, so they were able to get his Bitcoin keys, resulting in the trove ultimately auctioned off to Draper.)

Where’s It Going?

Anyone can start a new currency. Throughout U.S. history there have been several private attempts (our favorite was called the SEED, and was issued by our friends just north of us in Mendocino County, California, in the 1990s), although none succeeded.

While China, Russia, Taiwan, India and Indonesia alerted their Central Banks that Bitcoin is forbidden, throughout the world they are traded as freely as they are in the U.S.

Here, the Internal Revenue Service made the obvious observation that since a Bitcoin’s value is determined by a market, it’s property, and so they treat it as such. To report taxable events in Bitcoin, they require you to convert it to dollars on the day the event takes place; their comprehensive guidelines explain how to handle it legally in every instance.

So far Target, Victoria’s Secret, Zynga, PayPal, Ebay, Tesla, Etsy, Tigerdirect, Zappos, Home Depot, Gyft, Microsoft Xbox, Bloomberg.com and, perhaps significantly, the Republican Liberty Caucus and several Congressional candidates’ campaigns all accept Bitcoins, the latter officially sanctioned by the Federal Election Commission.

And according to one breathless participant on a Bitcoin forum, Wells Fargo accepted Bitcoins as legitimate assets that helped him get approval for his first home loan.

Other heavy hitters besides Draper believe in the currency’s validity and future. Former Managing Director and Global Head of JP Morgan Chase’s $3.4 billion Transaction Services business (and Deutsche Bank alumnus) Paul Chase recently became the Chief Financial Officer for Circle, one of several bank-like service providers helping to move Bitcoin into the mainstream.

But it’s important to remember that Bitcoin remains a volatile and exceedingly risky investment. Bitcoin.org itself tells you not to convert money into Bitcoins that you can’t afford to lose, which is the same advice given by the Financial Industry Regulatory Authority.

What’s the Point?

Nevertheless, the Bitcoin phenomenon has clearly captured imaginations worldwide, and the allure of a perfectly anonymous and highly secure method to conduct transactions appeals to a far broader market than just those trying to dodge the law.

While it’s impossible to predict what might happen with Bitcoin, this demand for secure transactions has been rising steadily as payment processing has become ever more digitized, and the demand seems to be strongest when people have a lot of money on the line.

That’s why many consumers who may not yet be ready to make a leap into the Bitcoin world turn away from digital payments altogether when they make significant investments. They write checks instead, knowing that they are among the most secure forms of payment and that they have the highest rating for bookkeeping accuracy.

Merchants might keep their eye on the Bitcoin phenomenon to determine when accepting them could increase their sales. But in the meantime, accepting checks can help you capture that same market. Learn how to guarantee that you’ll receive payment on everyone here.