One would like to think that when the S&P 500 topped 2,000 for the first time in August it would have been cause for nationwide celebration, especially since it culminates a 5-year bull run in the stock market and has some analysts predicting a 20-year bull market.

One would like to think that when the S&P 500 topped 2,000 for the first time in August it would have been cause for nationwide celebration, especially since it culminates a 5-year bull run in the stock market and has some analysts predicting a 20-year bull market.

But we’re not celebrating, and the reasons why have impacted the payments industry in unexpected ways relevant to many business’ payments policies, and perhaps relevant to their marketing as well.

Where’s the Party?

One reason we’re not celebrating has become starkly clear even to Wall Street: wealth inequality has reached a dangerous level, with the wealthiest 400 Americans owning as much as the poorest 150 million, or put another way, the richest 0.000001% of the population has as much as the poorest half. It should come as no surprise that 53% of Americans have nothing invested in the stock market, making news of its rebound less inspiring.

The traditional argument that the poor – now half the country – can’t invest because they don’t work hard enough to provide for themselves no longer holds water. Even plutocrats observe that a $7.25 minimum wage traps people in poverty, and that shipping 5 million world-class manufacturing jobs overseas since the 80s was probably a mistake.

Our current situation results from decades-long trends that were dramatically amplified by the recession, which cost 11 million people their jobs and eliminated 20% of all construction work, the implications of which are still with us four years after the official end of the recession.

That hurts, but Americans are not easily held down, and despite taking these body-blows and enduring a “jobless recovery,” median income is finally going up again.

Payment Types and the Recession

One main reason is that Americans, from Millennials to Boomers, are far more fiscally conservative today than they have been in generations. Their willingness to take on debt has probably never been lower and their search for value has perhaps never been as demanding.

Which brings us to payments. How does one define value when assessing a type of payment? How do payment types impact your customers and your profitability? Should you accept plastic? Should you accept checks? What are the inherent fraud risks with both payment types?

Raising All Prices for Two Companies

Depriving customers of checks highlights a contentious issue in the payments processing marketplace that makes practically every purchase in the country more expensive – pretty much exactly the opposite of what consumers look for today.

The majority of merchants who accept credit cards raise prices as much as 3% across the board just to cover the payment processing costs associated with plastic, and they have done so for years.

Until very recently they had no alternative because credit card companies did not allow businesses to break out the fee to charge it only when someone actually used a credit card. Merchants who violated this policy stood to lose their ability to accept credit cards, a disastrous prospect for most of them that left little choice but to increase prices across the board.

Until very recently they had no alternative because credit card companies did not allow businesses to break out the fee to charge it only when someone actually used a credit card. Merchants who violated this policy stood to lose their ability to accept credit cards, a disastrous prospect for most of them that left little choice but to increase prices across the board.

If this sounds unjust to you, you’re not alone. “Interchange fees” have caused passionate conflict for decades, with the harshest critics recalling that the American Revolution was triggered because of “taxation without representation,” which is what this seems like to some analysts.

Credit card companies didn’t want merchants to charge their fee separately because they worried that people might choose to use the least expensive payment methods, which would have not only introduced competition between them and other forms of payment but would have also invited competition amongst credit cards themselves, enabling consumers to choose the card that cost the least to use.

How to Lobby Congress in an Emergency

How it is that credit card companies were able to enforce such an anti-competitive policy? The answer may be related to the same systemic problems that have led to such dramatic wealth inequality: huge corporations enjoying government protection do not have to compete on a level playing field.

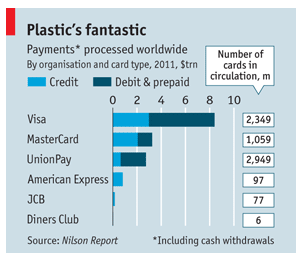

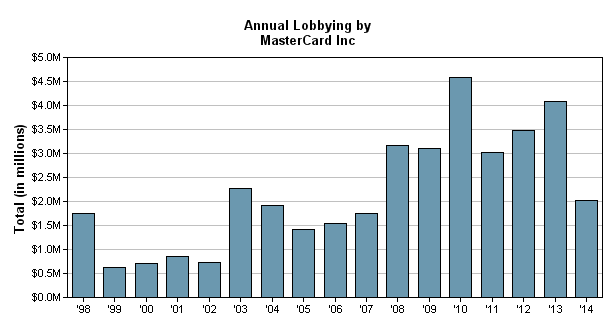

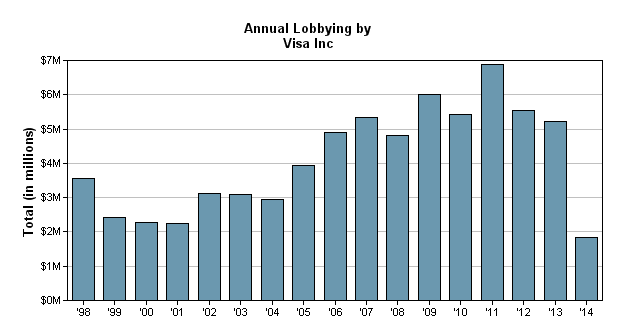

Credit card processing is dominated by two companies: Visa and MasterCard. The two charts show how much they spend lobbying Congress every year. You can see how they both panicked during the recession, seeking influence and perhaps favors, probably because Americans closed 400 million credit card accounts over those years.

You can also see how they seemed to trade off expenses in tandem for 2009 and 2010. That’s interesting because an amendment to the 2010 Dodd–Frank Wall Street Reform and Consumer Protection Act allowed merchants to break out credit card processing fees if they wanted to charge them only to customers using credit cards.

Seeking Justice Instead of Higher Prices

Speaking about related litigation, Wal-Mart said that “Visa’s monopoly power has enabled it to dictate price and inhibit competition,” and that fees charged by MasterCard and Visa are “far in excess” of associated network and bank costs for processing the underlying transactions, going so far as to call into question the actual value of the service the two processors provide.

Elements of the litigation that sparked Wal-Mart’s comments began, believe it or not, twenty years ago, giving you an indication of how intense this conflict has been. In 2012 Federal court finally awarded a $7 billion settlement to merchants who had sued for damages, and ordered the credit card companies to change their policies. Visa and MasterCard contested the ruling and managed to hold off adjudication for another year, but last December the courts assured them that they had lost.

Some merchants have taken advantage of the fact that they can add a credit card processing fee to purchases made with plastic, while the majority has taken a wait-and-see attitude.

Whichever category you fall into, you’re certainly aware that the payments market has changed considerably in recent years. Consumer preferences evolved as dramatically as financial literacy over the course of the recession.

Merchants interested in using payment practices to appeal to their target markets need to know how. We’ve prepared an analysis just for you.