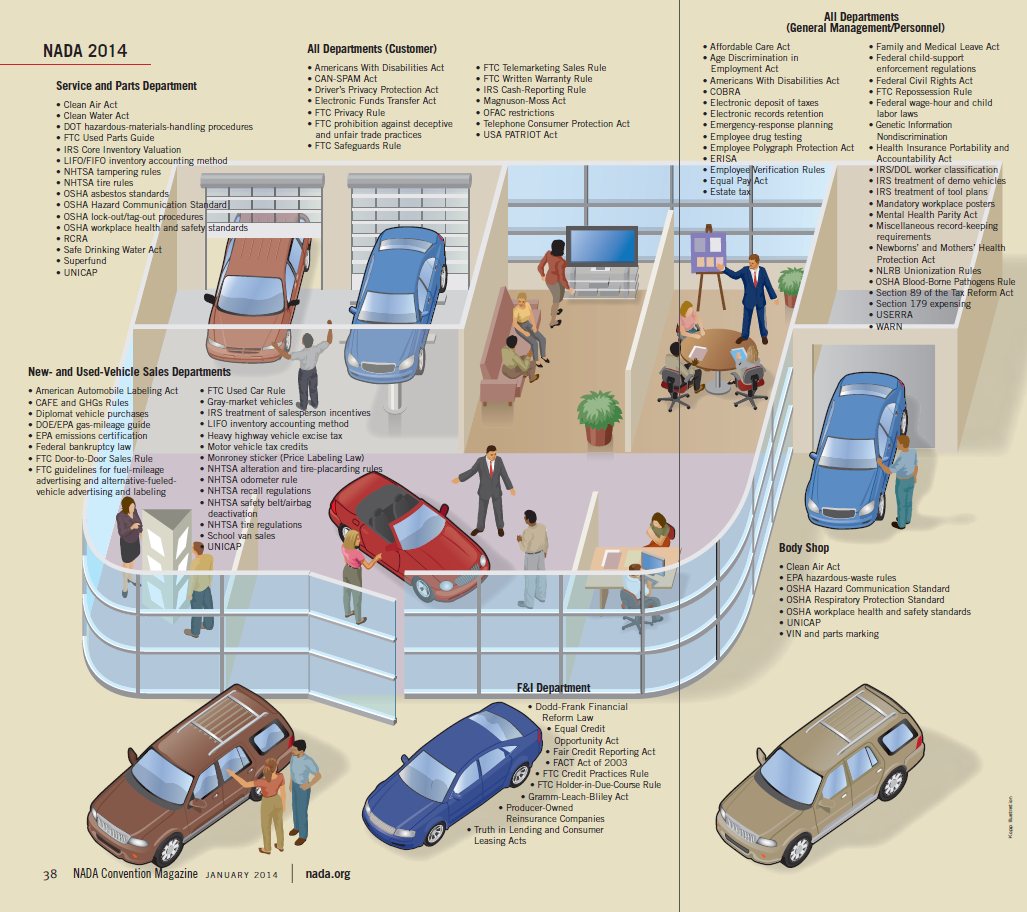

Auto dealers spend almost 22% of their pre-tax profits complying with regulations, largely because practically every regulatory agency – from FINRA to OSHA to the EPA – has their eyes on what you’re doing. An infographic in the NADA Convention Magazine from earlier this year clarifies just how extensive these regulations are (click the pic to expand):

The ones having to do with finance and insurance wrap next to the blue car at the bottom, which may give a slightly misleading visual impression that they aren’t as onerous as some of the other, longer lists. However, F&I regulations account for a solid 37% of your regulatory compliance costs.

Some regulations have a positive impact on your business. The dealership model itself is legally protected by regulations disallowing manufacturers to sell direct, for example, while environmental and employee safety regulations keep your staff healthy and your community clean. It’s easy for the public to understand their value, and it is also easy to spot infractions or businesses operating at the very lowest limit of compliance. Regulations like these maintain a level playing field for honest competition, and all told they add less than $100 to the price of a car.

Finance Regulations Are Different

All of that changes in the F&I department. While most of these regulations are designed to protect the consumer, by their very nature they are difficult to understand and so most people have no idea if a dealer is complying with them or not. Because of that, they create an area where unscrupulous or devious dealers can try to tip the playing field and lure unsuspecting customers into transactions that you could beat if the playing field was truly level.

Embracing Regulations to Close Sales

It may help your sales staff to close deals if they have a general understanding of the most important regulations regarding finance. Since most buyers go to more than one dealer before making a purchase, providing your customer with clarity regarding her rights might make her feel more comfortable and secure in doing business with you. Here are a few of the most important:

- Truth in Lending Act contains many of the provisions specifically relevant to car loans, and since just the pamphlet describing it is 128 pages long, it is safe to assume that most consumers understand only the broad outlines of how the Act protects them. Page 15 explains how APR must be calculated, and if a salesperson demonstrates an understanding of just this she may build customer confidence overall.

- Fair Credit Reporting Act, Regulation Z is particularly important to you since it explains exactly how the percentages and fees for a loan must be defined and described, with the express intent being to level the playing field and to make it easy for the consumer to make accurate comparisons. This one has real teeth: one willful compliance violation can cost you $5,000 and a year in prison.

- Gramm-Leach-Bliley Act requires dealerships to explain to their customer exactly what information they are going to share with other institutions –such as a credit union – and how they are going to protect it.

- Red Flags Rule requires dealers to have a written Identity Theft Prevention Program. You may need a lawyer to help you write one, but if you give sales a copy you may be the first dealer your customer has ever met who has it in the showroom.

- Magnuson - Moss Warranty Act governs the way you present information regarding warranties to a consumer, again with the express intent is making it easy for consumers to compare warranties accurately. Encourage your sales staff to ask about how competitors described their warranties.

- Used Car Rule defines how you must display information about the car and its warranty and lease option, again to make sure consumers can make accurate comparisons. Anyone who sells more than five used cars a year must comply, and referring to it may be a great question for customers coming to you after visiting a bargain-price competitor.

Since using F&I regulations creatively may boost customer confidence and help close deals, be sure that your creativity extends all the way to the very close of the deal. Don’t let a customer walk out when you can offer them a multiple- or hold-check option where they can write two to four checks to be cashed over the course of the next thirty days to meet their up-front costs.

Demonstrate that you take identity theft seriously by using remote deposit capture to deposit or queue those checks, sending their information to a processor with the highest Better Business Bureau rating possible and then giving the paper check, voided, back to the client. And to protect yourself, be sure that your check processing company guarantees all approved checks so you know you’ll get paid.

Regulations may be a necessary evil, but bounced checks can be a thing of the past.