As gasoline prices began to collapse last year – especially after November when OPEC decided not to prop up the price – pundits everywhere wondered how it would impact demand.

Would people buy fewer electrics and hybrids?

Would they buy bigger, less fuel-efficient vehicles?

Or is the price of gas only one of many factors impacting demand?

The simple answers are “Yes,” “Yes” and “Yes,” but simple answers may not be enough to protect your sales margin this year and in the years ahead.

Gas Is the Inverse of Electricity

As with any attempt to peer into the future, it makes sense to wonder about the data you’re analyzing. True, shifts in gas prices impact everything from discretionary income to consumer goods.

But can we draw a cause-and-effect conclusion about a single segment of the car market? The pundits don’t dwell on this sort of thing, mostly because it takes all the fun out of crunching numbers.

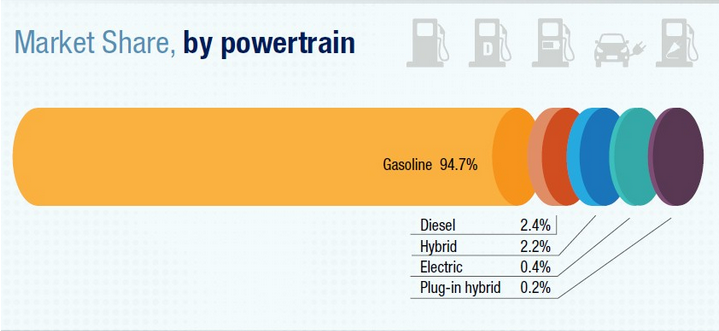

Still, if you look at this chart from NADA, current as of May, you can see that alternatives as a whole make up such a tiny portion of the market that studying month-to-month sales fluctuations may be little more than an academic curiosity:

Most dealerships adopt the long-term view of their OEMs, who have invested billions in building alternative powertrains. They firmly believe that the market will move in the alternative powertrain direction eventually, no matter what happens in a given quarter.

And some of the data, slim as it is, supports that view. Over the course of the first quarter of this year, for example, EV auto sales surpassed those made the previous year, proving that demand for EVs was still strong regardless of the price of gas.

On the other hand, demand for hybrids dropped over the same time frame, indicating that people will forego fuel efficiency if gasoline seems to be dropping in price.

Deep Down, Everyone Wants a Truck

It could be that people simply prefer trucks and SUVs. May had the highest seasonally adjusted annual rate of sales that the industry has seen in a decade, hitting 17.7 million, which Edmunds attributed largely to SUV and light truck sales.

Even if the price of gas had an impact, it certainly can’t explain everything.

The fact that buyers can get a six-year loan fixed at 4.6% may be far more relevant. The same goes for the incentives. Dealers nationwide have been offering steep discounts for Ford F-150s, Chevrolet Silverado, GMC Sierras and Ram 1500s. Many offer discounts significantly higher than those offered by the OEM, providing cash rebates, package discounts, and other incentives that may slash the bottom-line price by as much as $14,000.

A buyer looking at that sort of deal might just figure he can pay for a couple of year's worth of fuel with the discount alone, even if the price of gas goes up.

Demand Arises in the Mind

When it comes to EVs, we could argue that people who want to reduce their carbon footprint will buy them no matter what the gas costs. Some analysts have concluded that since hybrids are still gasoline-powered vehicles, they don’t have the full-blown cool factor of an electric – at least, not from a strictly environmental point of view.

Since our first-quarter data indicates that the demand for electrics responded less to gas prices than did demand for hybrids, the “crossover” phenomenon might give us our biggest clue as to what might happen next.

Crossovers have inspired double-digit sales growth this year. They’re selling so strongly it’s changed the passenger car market, helping send anywhere from a fifth to a quarter of midsize cars into rental fleets – including, incredibly, a quarter of the Camry’s sold the first quarter.

It’s worth taking a look at how this might impact the market for electric vehicles, especially in 2017. Here’s a Nissan Murano, one of the best-selling crossovers:

And here’s a Chevrolet Bolt, a true electric car with a 200-mile range that will be available in 2017:

And the Tesla Model X crossover SUV, also due to ship in 2017:

If demand for light trucks and SUVs arises from the simple desire to own that type of vehicle, then these electric SUVs may throw open the throttle on alternative sales.

It’s entirely possible that America’s aging fleet of cars is owned, at least in part, by people who want to reduce their carbon footprint but who can’t afford a Tesla sedan, who need more than the Leaf’s 80-mile range, and who want a safe vehicle big enough for their family.

The OEMs are betting that this is the case, and they’re not basing their bet on the price of gas. They’re assuming that demand will be there no matter what happens, and they’re probably right.

So if gas prices aren’t the only thing driving consumer behavior, the lesson learned might be this: if you don’t have what people want, they’ll just wait until you do. Holding on to an older car doesn’t faze drivers anymore, and one reason may be that they’re waiting for the right alternative to come along.

The Bolt, the Model X, and their brethren might pull another segment of the population into the market, increasing alternative’s share from less than 3% to 5% or more between 2017 and, say, 2020.

Business happens when you meet demand, and so it’s always interesting to analyze the data you have. But meeting demand means more than just stocking the vehicles you expect your customer to want, so here’s another data point you might take into consideration:

When a customer decides to make a down payment or enter a lease – for any kind of vehicle – more than two-thirds of them will pull out their checkbook to close the deal.

Of course, you’ll accept their check, but why accept the risk that goes along with it? You have enough to wonder about given the revolution your industry’s going through. Eliminate your risk when you accept checks so you can contemplate the future without distractions from your receivables or collections. Find out how here.