When trying to polish their crystal ball to divine how the Federal Reserve's meeting next week might affect the heavy equipment industry, most pundits focus on the capitalization rate in real estate. Since it's a basic ratio measuring the yield on a real estate investment, it changes constantly with market forces.

But it can be blown out of the water by a shift in interest rates. And at this point, any slow down in the heavy equipment market's tepid recovery could reverse the fortunes of many dealers.

But it can be blown out of the water by a shift in interest rates. And at this point, any slow down in the heavy equipment market's tepid recovery could reverse the fortunes of many dealers.

While there's no direct relationship between the federal funds rate and real estate capitalization, there is a connection, and it's worth tracing it in an effort to prepare should rates rise.

All Eyes on the Fed

As you know, the Fed is not part of the government, even thought it's legal mandate is to maximize employment, stabilize prices, and keep long-term interest rates moderate. The Fed has nothing to do with the federal deficit or the government's means to handle its debt. It isn't allowed to buy Treasuries from the Treasury Department, and it has no control over how much it costs the government to issue Treasury bonds.

The Fed is part of the private banking system. Their mandate lets them set the target rate banks must pay to each other when they lend each other money. Banks do this continuously to comply with regulations that they have a certain percentage of their outstanding loans held in cash reserves (if they make even a slight mistake, they risk losing their FDIC backing, which would ruin practically any bank).

There's no direct relationship between the federal funds rate and mortgage rates, either, but we're getting closer. The rate banks pay each other has a massive impact on their operations. Even a slight increase in the federal funds rate can cost them a fortune.

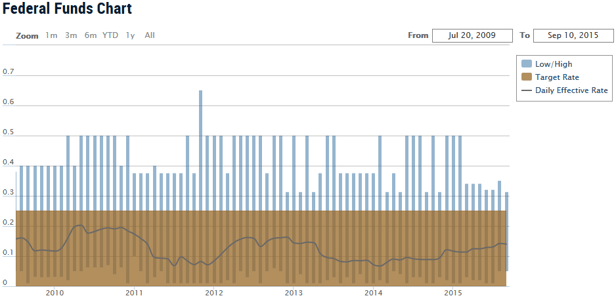

How slight? Well, take a look at this overly-complex chart from the NY Fed. The line in the brown area shows you the actual interest rate on these inter-bank loans, which are negotiated amongst the banks. You've been reading about this for months -- and all the hoopla is about fluctuations that are less than one tenth of one percent.

If slight increases cost the banks, they might pass that cost onto the consumer through higher interest rates on loans like mortgages. If they do that, then it will change the real estate capitalization rate. Which might be enough to knock heavy equipment's recovery off balance.

Thus, everyone furiously polishes their crystal ball.

Hot and Cold

The Fed instituted the current ultra-low interest rate environment in 2009 for obvious reasons -- after a catastrophically simultaneous collapse of the real estate, bond, stock and commodity markets, they went to extraordinary lengths to get money flowing again. "Quantitative Easing" allowed banks to continue operating by basically fronting them money (with the backing of Congress and the Bush and Obama Administrations) so they could meet their cash reserve requirements. And they slashed the Federal funds rate to nothing so as to lubricate the banking system.

It worked, albeit slowly. The country is now packed full of people paying less than 4% interest on their mortgages, for example, which is arguably the main reason they have the mortgages in the first place. If the rate had been higher, that business might not have happened.

On the other hand, if the rate stayed at zero forever, then money would flow too freely, prices would take off, the market would inflate -- and then burst. The Fed is supposed to prevent that from happening -- which is, of course, impossible -- but if the economy heats up they will try to cool it down by increasing the cost of loans on Main Street by increasing the federal funds rate in the banking industry.

Short version: if they think the economy is heating up, they'll raise rates to cool it down. So, how do we know if it's heating up?

Employment, which the Fed is supposed to maximize, is a major consideration. Right now unemployment has fallen to 5.3%, which is great for the working class. At the 5% mark, economists say, the employment equation shifts into the workers' favor. At that point, there are lots of jobs and barely enough people to fill them, which pushes up wages for everyone. In the construction industry today competition for skilled laborers is already intense. The Fed might look at that and call it heat.

It will also look at the other thing it's supposed to do, which is moderate prices. The broadest measure of prices is the rate of inflation. There are several rates of inflation, and the one that's getting all the crystal-ball attention right now is the producer-price index, which basically measures inflation in B2B markets. It went up only slightly in August, which is weak. The other one getting crystal-ball attention is the price of goods, which is a B2C measure. It dropped 0.6% in August, which is weaker. Weak inflation means that demand is weak. The Fed might look at that and call it cool.

And why would demand be weak? For one thing, according to Zillow, more and more renters are losing faith that they will ever be able to buy a home. The Millennials are still missing from the housing market because they are saddled with high levels of student debt and they can't afford to buy in. Worse, without any large asset to work with they cannot start businesses. A study by the Kaufman Foundation concluded that the recession “dealt a permanent blow to Millennials’ entrepreneurial potential.” The Fed might call that cool.

And why would demand be weak? For one thing, according to Zillow, more and more renters are losing faith that they will ever be able to buy a home. The Millennials are still missing from the housing market because they are saddled with high levels of student debt and they can't afford to buy in. Worse, without any large asset to work with they cannot start businesses. A study by the Kaufman Foundation concluded that the recession “dealt a permanent blow to Millennials’ entrepreneurial potential.” The Fed might call that cool.

On the other hand, in July construction spending climbed to over a trillion dollars, hitting its highest mark in seven years. And to the Fed, that probably looks like heat.

Capitalization Rate at Stake

So will they raise the rate or won't they? Of course they will also look at international currency fluctuations, the situation in China, the situation in Europe, and a number of other factors before they make their call.

But no one knows what they're going to do. According to the Wall Street Journal, back in August, fully 82% of the economists they surveyed thought the Fed would certainly raise rates. As of now, that's dropped to 46%.

Which is probably a good thing. If a small move in the Fed rate had a slightly larger impact on some of your builder's capitalization rate, that could mean the difference between buying a new machine this year or waiting until next year, or the year after that.

Since the Fed has brought this risk to your business, now may be the time to eliminate any source of risk you can control. Some of our heavy equipment dealers receive up to 70% of their revenue in the form of checks, and they have us guarantee every one of them. If you process a check in accordance with your Service Agreement and it's returned, you get paid anyway and we deal with the problem. Be sure you're safe no matter what the Fed does.