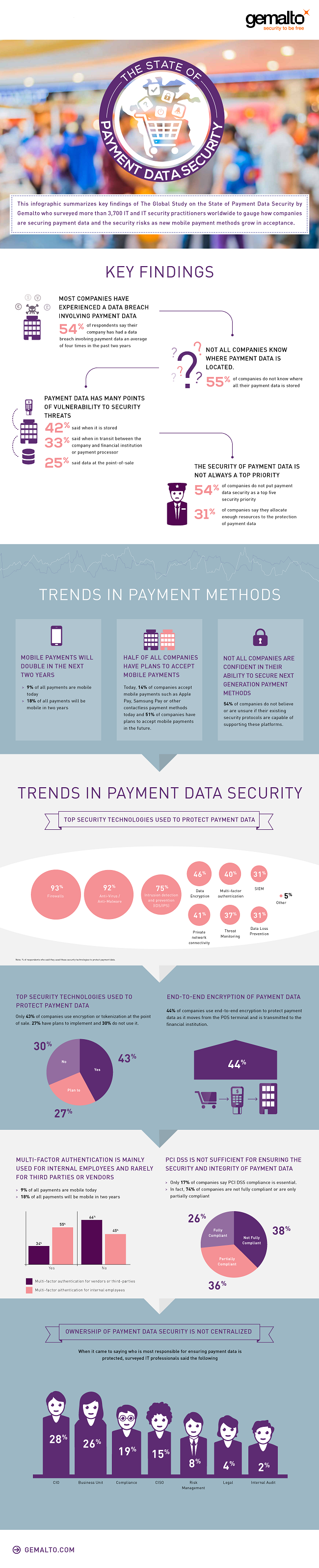

A January 2016 study concluded that modern payment methods are jeopardizing the security of payment data. The impact of the “Global Study on the State of Payment Data Security” was determined after researchers surveyed 3,773 IT and IT security practitioners worldwide, including the USA and Europe.

A January 2016 study concluded that modern payment methods are jeopardizing the security of payment data. The impact of the “Global Study on the State of Payment Data Security” was determined after researchers surveyed 3,773 IT and IT security practitioners worldwide, including the USA and Europe.

On the global scale, 72% believe “new payment methods such as mobile payments, contactless payments and e-wallets are putting payment data at risk” while an alarming 54% say their company’s payment data has been breached in the past two years.

The word from American IT professionals fares no better:

- Only 44% say the protection of payment data is a top-five priority for their organization

- Only 41% say existing security technologies to protect payment data are effective

- Only 38% say their security personnel has the expertise to effectively protect payment data

- Only 30% say enough resources are allocated to the protection of payment data

The study concluded: “As companies move to accept newer payment methods, their own confidence in their ability to protect that data is not strong.”

Looking at the silver lining, “53% believe they are more effective in securing traditional point-of-sale, credit cards and checks than mobile payments or Internet payments.”

CrossCheck provides an even greater level of security for traditional payment processing and payment solutions with its Check Guarantee program. Checks are approved for merchants at the point of sale in seconds via terminal, phone or the web before being deposited. If an approved check is returned from the bank unpaid, merchants can submit it to CrossCheck for processing and reimbursement.

About CrossCheck

CrossCheck, Inc., an established leader in the payment solutions industry, processes billions in check-transaction dollars annually throughout the United States. Since 1983, it has helped increase profits and reduce risk for businesses in verticals such as automotive, auto aftermarket, building materials, home furnishings, specialty retail, medical-dental and veterinary by providing efficient and affordable check verification, guarantee and conversion services. CrossCheck’s suite of services includes check conversion technology, web-based transactions, remote deposit capture and premium products for specific industries and applications. The company has offices in Petaluma, California and Irving, Texas.