Since the CBO expects us to run out of money for infrastructure this year, now might be a good time for building supply company owners and managers to make two critical decisions: first, what they want to say to their elected leaders, and second, what they want to say to their customers.

Since the CBO expects us to run out of money for infrastructure this year, now might be a good time for building supply company owners and managers to make two critical decisions: first, what they want to say to their elected leaders, and second, what they want to say to their customers.

The message to elected leaders may be the more challenging of the two, mostly because the building industry’s point of view can’t be summarized in a bumper sticker or a thirty-second commercial.

Everyone in the industry knows that the American Society of Civil Engineers gives our country’s infrastructure a “D+” overall, with our roads getting a lowly “D.” It’s pretty obvious why they call for $3.6 trillion in infrastructure investment between now and 2020.

The Common Sense Formula?

But while putting a price tag on the problem certainly helps, it also tends to obscure deep divisions about how money, when available, gets allocated. Last year we spent $416 billion on water and transportation infrastructure. Two-thirds of it went to transportation, and 60% of transportation’s money went to highways.

But that doesn’t mean crumbling roads and bridges were repaired, because federal money must be distributed according to a formula linked to how much gasoline tax each state contributes to the Highway Trust Fund.

In other words, money doesn’t necessarily go where it’s needed. The formula is sort of a double-edged sword: while it might help corral politicians and reduce back-room deals, it may also hamstring them and prevent them from acting upon common sense.

Political ROI

The upshot: some communities end up with money to fund marginal projects, while others have no money for ones that clearly need to be handled.

Efforts to improve the situation have met with serious challenges, as is usually the case in politics. For example, back in 1959, when the interstate highway building boom peaked, the U.S. spent 3% of its GDP on infrastructure. For the past three decades, it’s been only 2.4% -- except for 2009-2010.

With the passage of the recession-rescue American Recovery and Reinvestment Act, infrastructure spending went up to 2.7%. The bill funded several revitalization programs, and with a $34 billion allocation, infrastructure was the third largest expenditure.

Seems like a good idea. But if we look at the “transparency” section of the Act’s very own website, we find that the largest infrastructure line item was $6 billion for “Environmental Protection Agency-State and Tribal Assistance Grants,” which some might consider a less-than-transparent description of what exactly happened to those billions.

If politics always present problems like that, the infrastructure situation may be becoming even more complex. Now, some people question the need for infrastructure investment in the first place.

Andrew M. Warner, an economist at the International Monetary Fund, published an influential paper last year that contradicts one of the longest-held assumptions in the building supply industry: that infrastructure investment provides massive pay-back.

What was the country’s ROI on the interstate highway system? On the power grid? On clean air and water? On the Internet? It seems obvious that the payback was massive, but it’s also obvious that quantifying that pay-back in economic terms may be exceedingly abstract. It’s also clear that the payback took place over very long periods of time, making it even harder to quantify.

Warner showed that infrastructure investments around the world did not spur economic booms, indicating that investment provides little short-term payoff, but other IMF analysts see things differently. Another report concluded that the case for infrastructure spending was strong – but only if allocations followed “efficient public investment processes.”

Speaking Truth to Power

In other words, if your government is responsible, then your infrastructure investment will probably generate a return.

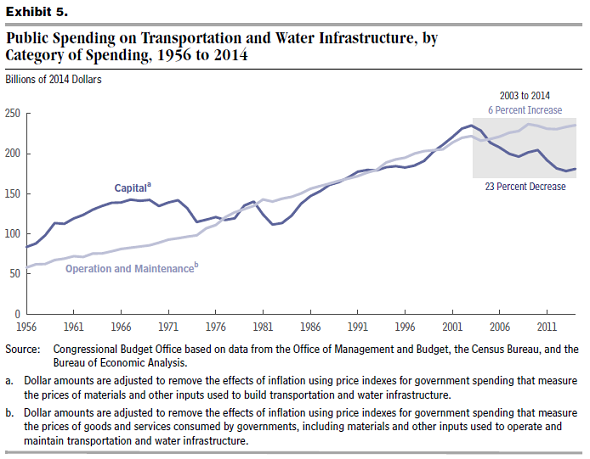

So if it all comes down to who is in office, it’s likely that this election cycle will involve passionate discussions of the infrastructure question, especially since maintenance costs have continued to spiral upwards as we invest less and rely upon old structures more:

Building supply owners and managers might consider themselves their community’s experts on these issues. They’re complex and critical, and they will impact your business for years to come.

They also impact your neighbors and your clients, who may be more comfortable taking insights from you than from Washington -- especially considering how well “transparency” seems to work at the federal level.

We couldn’t figure out what was built with the billions in the Recovery Act’s biggest line item, but the second biggest line item is both clear and alarming: We spent $4 billion on the “GSA-General Services Administration-Federal Buildings Fund.”

Inspiring Your Customer

So if “State and Tribal Assistance” and “Federal Buildings” are #1 and #2 on the infrastructure part of the “Recovery Act,” no wonder the public’s reaction is to resist taxes across the board, even as they watch their highways and bridges crumble.

That will become even more of a problem for the building materials industry when Highway Trust Fund taxes come up for the axe in September of 2016.

Given all of this turmoil, now may be the most important moment in your career to think about what you’d want to say to your elected officials.

Figuring out what you want to say to your customer is much easier. You want to say “Yes!”

Your customer has finally got a great contract and wants you to haul materials out to his site and he wants his guy to hand you a check for it when you get there – and you want to say yes. Your customer shows up at your lot and wants to drive off with a load after handing you a five-figure check – and you want to say yes.

But you don’t want to risk the relationship, the potential for that relationship, or the money in those checks. You can say “Yes!” to your customer and eliminate the risk of a returned – even a stopped – check, and you can do it for less than it costs to process a credit card payment.

Learn how to use check guarantee today, because you can’t be distracted with outstanding receivables this year. Your customers and your community need more from you, and they need it now!