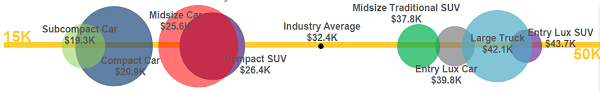

The average price of a car in 2014 was $32,386, the highest ever, but auto dealership owners and general managers might find that this is most interesting aspect of that record: virtually no one paid $32,386 for their car.

The market’s bifurcated right along with the American economy, with practically all sales falling either under or over the average and with very little activity in the middle:

Analysts attribute this to several factors, with two stand-outs: on the low end we have an impressive plethora of new, affordable vehicles coming from virtually every manufacturer, many of which compete successfully with used cars. And at the high end we have an equally impressive flood of new technologies that the market clearly wants and that many buyers are happy to pay for.

Leasing Changed the Lower Half of the Market

To get a better picture of the low end, we need to include used cars, which themselves enjoyed a 6% increase in price and are now approaching an average of $17,000 – another record high.

Lease returns drove this phenomenon, and nearly one fifth of the used cars sold last year were two years old or less. Many of them came with Certified Pre-Owned warranties.

And all of them were easier to finance. As manufacturers continuously enhance the quality of their products, many consumers have concluded that buying a lease return with the intention of keeping it for five years or more makes good economic sense – especially since they can get affordable loans.

In fact, as the average term of a used car loan steadily increased to just over sixty-five months, buyers could get one that had monthly payments smaller than they were before the recession.

It should come as no surprise that this equation makes the most sense to younger buyers, although it’s compelling across the whole age spectrum. Nearly a quarter of Millennials will buy used, as will about a fifth of buyers between 35 and 54 years old.

Even still, a fifth of Millennials will opt for one of the entry-level new vehicles, as will the same portion of buyers up to 64 years old. Cars are fine, but they’ll vacuum up every compact SUV you have before you even position it on your lot – that vehicle type has captured America’s imagination and there’s good reason to think that new sales today will be strong used sales when they come back.

Regarding the Millennials, you may want your sales staff to know that three quarters of them think they’re savvier car buyers than their parents. No need to argue the point; but do make sure your salesperson can be contacted via text, as the vast majority expect to interact with her that way. Other than that, they’re regular buyers: they all want a test drive and most want to deal with you face-to-face when it comes to closing the deal.

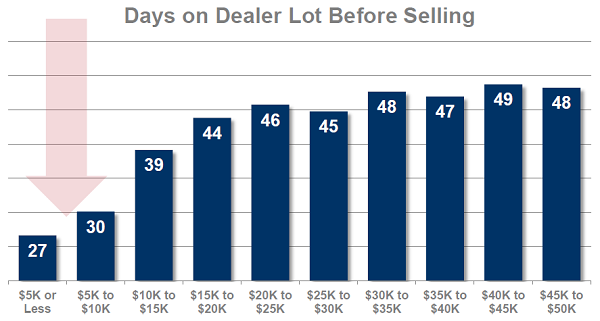

This summer, analysts expect demand to be high for your used cars, especially the ones that cost $15,000 or less. In that price range, you’ll probably sell it in five weeks, where it will take you six or seven to move any of the higher-priced cars.

Technology Changed the High End

It should be relatively easy to keep this ball rolling, as nearly half of all luxury cars moved last year were leased. They accounted for only 11% of the market but generated 18% of the revenue; the average lessee agreed to a $659 monthly payment and a thirty-five month term.

These buyers chase technology as much as luxury – so much so that manufacturers have become leery of Google and Apple. Competition for the dashboard screen has already spread well beyond playing music and taking calls from your smartphone.

Demand for further integration shows no sign of slowing down, at all, and some OEMs worry that their cars might become a battleground for technologies they don’t control, or that their own software development efforts may be pushed to the sidelines by the behemoths.

No OEM wants third-party software companies downloading upgrades to their vehicles, as Tesla already can, nor do they want your phone to become the co-pilot of your self-driving car. But right now, market forces leave them little choice but to offer integration. Forbes quoted Ford CTO Raj Nair: “We want to make sure you are not pushed into a decision on a $40,000 car based on your $200 smartphone.” So they have to play nice with all of them.

The battle to control this technical space has just begun, and with both Google and Apple intently eying the auto market, we can expect it to become ever-more relevant to high-end sales in the next few years.

Nothing’s Changed Regarding Your F&I Department

No matter whom your customer is or what they’re buying, more than half of them just want to complete their purchase and take their car as quickly as possible.

They feel that entering your F&I department is like falling down Alice’s rabbit hole. A third of them become confused by the choices you offer, which may slow down the process and discourage your new customer (even if he is savvier than his dad).

The solution? More than four in five buyers of all ages want you to lay out all of your F&I choices on your website so they can review them before they talk to you. Your gut reaction may be that doing so would cost you revenue that a skillful F&I salesperson might capture in a traditional meeting. While that may be true, it may also be true that transparency on your part will attract more customers – and that it may generate the kind of positive buzz that only today’s wired clientele can.

In fact, the more your customer knows about your business, the more comfortable they may feel – especially the more they know about your F&I department, since they can find everything else online already.

We can contribute, and we’re happy to do so since we’ve been serving auto dealerships for thirty-two years. For an overview of what’s happening in the payments space, and how you can turn it to your advantage at both ends of the market, we invite you to watch the on demand webinar found here.