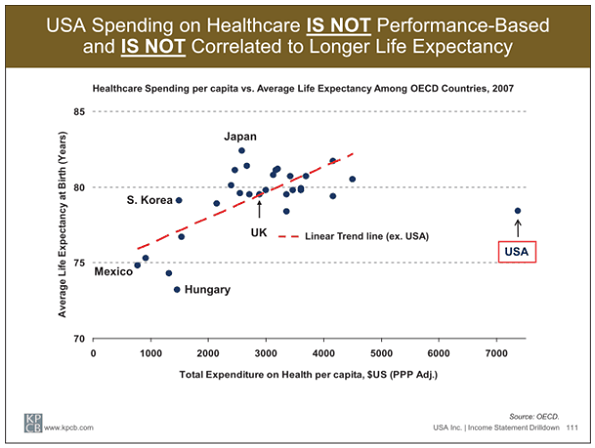

Some version of this chart has been trumpeted in the media for over a decade now, and while it’s clear that helped instigate demands for improvement, it’s not at all clear that the reforms it prompted will solve the problem.

The reforms have, however, forced a great deal of consolidation in the health care industry, and so entrepreneurial doctors who want to remain independent need to arrive at the best possible response to that market force.

Shark Tank

The environment can be fierce. Between 2009 and 2013 hospital acquisitions increased 14% annually. Hospitals acquiring other hospitals accounted for some of that, but mostly hospitals acquired physician-owned businesses, including both their basic practices and specialized centers.

Entrepreneurial physicians who intend to remain that way have focused on providing innovative solutions to their patients’ demands for transparency and value – demands that have risen in proportion to increases in co-payments.

And they have to do this while maintaining membership in an increasingly competitive and narrow network of payers. Physician’s Practice magazine says that “continual rate declines amidst increasing overhead and regulatory burdens are enough to dishearten even the most optimistic physicians and administrators.”

Payments from plans available in the exchanges generally amount to 20% less than comparable payments from an HMO, but even still many physicians find that the business resulting from inclusion can be profitable.

The real problem is trying to figure out which ones you should accommodate, and how to make sure you don’t miss any of the revenue coming from those patients.

Value for Whom?

“Value-based reimbursement” has taken over as the preferred term in the health care debate since it sounds like just the sort of thing that would remedy the problem depicted in that chart.

And while that’s certainly true in the abstract, proving “value” so you can get reimbursed has rapidly metastasized into a ponderous record-keeping problem. Because of this additional burden, while nearly two thirds of doctors think that it may be a good way to cut costs and improve patient care (in the abstract, at least), nearly half still don’t know how it will affect their business.

According to McKesson, “the market is ripe for disruption,” and since it will also grow 6.8% this year alone, entrepreneurial doctors might consider expanding their market share as they tighten up their operational procedures.

The First Way to Add Value

From a business point of view, providing value to your patient may be best accomplished by making your practice more valuable.

If you’ve ever had your business appraised you know that operational efficiency can make a big difference.

Improving it can seem exceedingly difficult, especially to doctors accustomed to overseeing practically every aspect of their operations. That’s inefficient, but perhaps we can separate your burden into two categories: medicine and business.

You probably should keep your eye on the business.

But your nurses might be able to do a lot more of the medicine for you than they do now. The profession seems to have evolved faster than doctor’s perception of it.

Today’s nurses have master’s and doctoral degrees, and universities from Yale to UCLA expect them to help develop clinical practices scientifically. They do, after all, make up the largest segment of the healthcare workforce – and policy makers and community leaders don’t hesitate to turn to them for expertise on what “value-based” care actually is. They already perform a number of functions formerly relegated to doctors, and the more they can do for you, the more valuable your practice may become.

The Second Way to Add Value

If optimizing your nurses can create some capacity, one way to profit from it may be to earn the “Patient-Centered Medical Home” (PCMH) designation.

One of its main goals serves your long term business interests: developing “relationship-based” care coordinating services from several sources and serving as a “home base” for the patient between them.

It requires “enhanced in-person hours, around-the-clock telephone or electronic access to a member of the care team, and alternative methods of communication such as email and telephone care,” and the process for becoming one may require considerable effort.

But having the designation makes you more attractive to payers and makes it easier to earn inclusion in the exchanges.

More importantly, if you have it some payers will offer higher reimbursements.

The Third Way to Add Value

So if you off-load some of your medical work to your nursing staff and assign a front-office person to initiate your PCHM designation, you may have a little extra time to evaluate your business.

Are you buying? Partnering? Selling? Either way your financial health will determine your options, and since many business owners come close to needing a doctor when they look at their receivables, you might want to address that issue first.

While it’s true that you have only a one-in-ten chance of recovering a debt that’s over 120 days old, it’s also true that you can eliminate receivables incurred because of returned checks.

Why waste resources and compromise operational efficiency by chasing patients for payment? No matter what your business plans may be, securing your revenue will make them easier. Scan and deposit checks when you receive them, knowing that the revenue they represent is guaranteed.