The best sales strategy for the next few months may be to position yourself for an entire year of sales.

Just how to do that starts with understanding your market, and acting now to respond.

Sure, fifty-three times last year Wall Street closed at a record-breaking high, but for Main Street the year meant enduring something of a shaky nail-biter, with severe weather numbing its start and jittery non-committal customers keeping it from settling down.The Holidays May Keep Giving

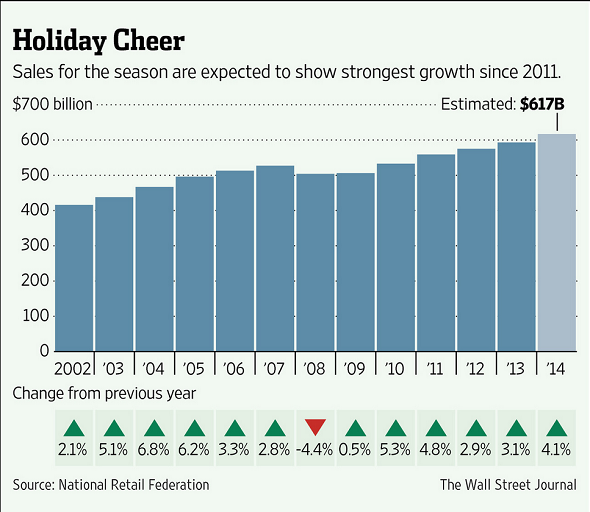

Thankfully towards the end of the year those jitters seemed to collectively calm, and customers decided that they could afford to be generous for the holidays after all. Over the last quarter of 2014 the economy expanded at its fastest pace in eleven years.

And it looks like Super Saturday, December 20, beat out Black Friday as the biggest holiday shopping day, with retailers racking up $23 billion in sales nationwide on that one day alone.

Even better, 2015 looks like it could be the first year since 2008 that won’t be a nail-biter. About half of small-business owners say they expect the economy to keep improving, and four out of five think their sales will increase.

If you’re one of them, now may be the time for capital investment – and 2015 holds an interesting surprise. Small-business funding might become easier to obtain in the months ahead. The Jumpstart Our Business Startup Act of 2012, which allows regular entrepreneurs to raise money from “crowd funding” in a way somewhat similar to an IPO on the New York Stock Exchange, should be fully implemented by the Securities and Exchange Commission this year.

If you’ve been waiting for the recovery to make a move, this could be a game changer. Once the SEC rules are set, analysts expect to see a jump in activity. And if the law works as intended it might pave the way for new capital development all across your community – maybe including you. If businesses can expand, that will certainly create jobs.

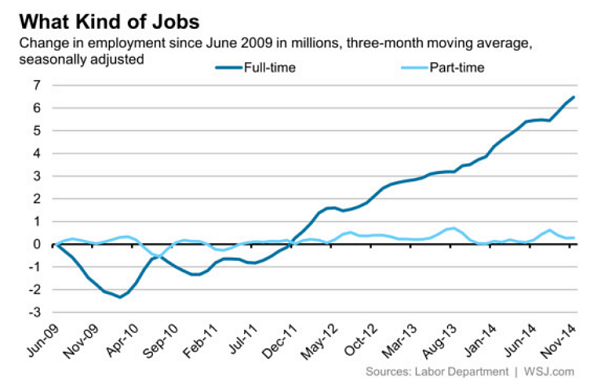

And employment is probably the most solid reason to believe that any business development you do this year will pay off: your customers are fully employed for the first time in years.

A study done by the Wall Street Journal found that the vast majority of new jobs created are full-time positions, despite rumors to the contrary. With that stability, it might be reasonable to expect wallets to open more often this year.

How to Get Money Flowing Your Way

So if the country’s turning a corner, how can you make sure those wallets open inside your store?

You know the answer: focus on your customer relationships, because people who have done business with you before are far more likely to do so again – and to bring friends.

No matter how well you added new people to your contact list over the holidays, working that list and/or your social media presence for the first quarter might be a low-cost, high-return proposition setting you up for as much repeat business as possible during the 2015 holiday season, even if its months away.

A study by Cornell University might provide a clue as to how.

They found that customers who receive an unexpected gift often feel that they should reciprocate by being generous.

And they found that if the person offering the gift is really friendly, the customer will be even more generous.

How to Use the Super Bowl for a Better Valentine’s Day

So we might conclude that the best “relationship development” you can do between now and the next major shopping holiday, Valentine’s Day, might be to somehow give a free gift to as many good prospective customers as possible.

And the Super Bowl might be the perfect reason to. Of the 310 million people in the United States, 115 million of them watched the Super Bowl last year, and it’s always one of the most-watched events on television. So use it as your own gift-giving event.

It happens on Sunday, February 1, so between now and then you might set out to make as many customers smile as possible, each time with a nod towards Valentine’s Day shopping and the holidays beyond.

Deciding on the free gift may be the easiest part. A package of cocktail napkins or something equally simple – and inexpensive – may be all you need.

Effectively getting people to take advantage of your gift may be more challenging, but there’s no magic bullet, so stick with the basics: tweet about it, post it on Facebook, send a short email, and have a sign in front of your store.

Making an effective presentation may be your real ticket to growth, so think about how to advance your relationship with the prospect holding your gift.

You might, for example, attach another gift to the first one specifically designed to feed your marketing efforts. Include a card with your business cell phone number and promise that everyone who sends you a text will get a Valentine’s Day discount texted back to them on Saturday, February 7 – the weekend before.

When you give someone a gift it’s reasonable to expect them to reciprocate by giving you their cell phone number. It’s also reasonable for you to expect them to look over your merchandise with a greater intention to buy something.

But it’s critical not to require anything in return; because doing that unravels the entire positive feedback loop you’re trying to create.

Don’t Judge a Customer by “Its” Gender

And also be sure not to assume that your male customers will be focused on football while your female customers will be focused on romance.

The opposite may often be true.

Women are the fastest growing NFL audience and make up almost half of all NFL fans. More interestingly perhaps is the fact that psychological studies have concluded that men are more romantic than women.

Assumptions won’t work for payment options, either. Since the bottom of the recession one in five people, from Millennials to Silents, increased their use of checks. And one out of five purchases over $100 is paid for with a check.

There’s not a men vs. women difference here, either – you simply never know who will want to pay with a check, but you should know that a Federal Reserve study shows that most people never change their preferred payment method, and so it’s good business to make sure you can accept whatever they tender.

Now that we’ve had a truly jolly holiday season that might segue into a cheerful new year, make sure that every investment you make in your business results in more sales once you get your customer in the door.

Even between now and Valentine’s day, there’s still time for you to do just that by offering what many of our customers call “in-home layaway” and what you can call “guaranteed revenue.” Click here to learn more.