Boom times have arrived for remodeling contractors, and the situation looks to be stable and long-term. The National Association of the Remodeling Industry estimates that 81% of the remodeling projects done today were postponed from before the crisis. The industry rushes to play catch-up even as real-time demand begins to consolidate. Combine that happy state of affairs with positive trends in home prices and lending and it’s likely that remodeling materials as a percentage of your business will gather strength over the course of 2014 and beyond.

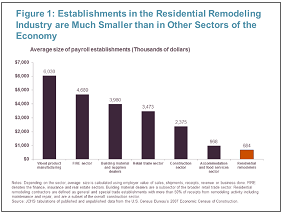

The opportunity brings some concealed risks with it. Since remodeling requires specialized knowledge and involves many skilled and hard-to-come-by craftsmen, remodeling businesses tend to be much smaller than other construction companies. A 2014 Harvard study by their Remodeling Futures Program found that the average remodeler has revenues just under $700,000 a year, compared to about $2.4 million for constructions companies generally, and while that can be profitable and rewarding for the owner, it does mean that building suppliers might want to be a bit more careful when filling remodeler’s big ticket orders.

The opportunity brings some concealed risks with it. Since remodeling requires specialized knowledge and involves many skilled and hard-to-come-by craftsmen, remodeling businesses tend to be much smaller than other construction companies. A 2014 Harvard study by their Remodeling Futures Program found that the average remodeler has revenues just under $700,000 a year, compared to about $2.4 million for constructions companies generally, and while that can be profitable and rewarding for the owner, it does mean that building suppliers might want to be a bit more careful when filling remodeler’s big ticket orders.

And they’re going to bring you big ticket orders. In their analysis of remodeling trends the Association of the Wall and Ceiling Industry found that now-revived projects potentially cost as much as 10 to 25 percent above the original estimate. Inflation makes up only a small part of that; mostly it’s due to the fact that many homeowners who had to wait out the recession now intend to reward themselves by investing in the best materials available. To the tune of $146 billion this year, in fact, which would set a new record according to the Harvard study.

Much of that money will come from HELOCs and second mortgages. An important reason is that 10-year appreciation on residential properties finally entered positive territory this quarter, showing a 0.55% increase over 2004. That, combined with plummeting default rates on second mortgages, has driven a 16% increase in equity lending this year, bringing it to $91 billion. And don’t think for an instant that we’re back to the go-go days of 2007 when banks wrote $310 billion in equity loans and smiled breezily as it was frittered away on luxury items and vacations. Today’s lender wants to know that the borrower will use the loan to create more equity, meaning most of that lending will end up invested in the property itself.

And many of those investments earn a respectable return almost immediately. In their annual survey, Remodeling magazine found that the average return on a remodeling project was over 60% -- meaning that as soon as the work is finished, the home’s price goes up more than half as much as the project cost. In fact, front doors tack on 96% of their value as soon as they’re hung, and this year sun rooms made the list for the first time, returning 51% of their value by the time the homeowners sits down with her first glass of sun tea.

And many of those investments earn a respectable return almost immediately. In their annual survey, Remodeling magazine found that the average return on a remodeling project was over 60% -- meaning that as soon as the work is finished, the home’s price goes up more than half as much as the project cost. In fact, front doors tack on 96% of their value as soon as they’re hung, and this year sun rooms made the list for the first time, returning 51% of their value by the time the homeowners sits down with her first glass of sun tea.

You want your part of this business, so when your favorite remodeling craftsman loads up on top-of-the line counter tops, cabinet fronts, doors, windows and specialized materials for his specialized project, the last thing you want to do is interrupt his train of thought by rejecting his check when he knows that he has funds to cover it. A lot of contractors pay you with checks to create a nice neat paper trial for their customer, and since almost all of them will write you a check only when it is good, you want to be sure that your check verification service produces as few declines as possible – and ideally you want verified checks to be guaranteed so that your cash flow is not interrupted by a faulty check writer. We offer both. Learn more about their benefits here.