When you’re in the afternoon rush or morning crush of taking payments at your business, it can be easy to forget the organization that facilitates the printing of the money you so eagerly accept. One way to never forget where that cash comes from is to tour the Federal Reserve System and learn more about its importance on our economy.

When you’re in the afternoon rush or morning crush of taking payments at your business, it can be easy to forget the organization that facilitates the printing of the money you so eagerly accept. One way to never forget where that cash comes from is to tour the Federal Reserve System and learn more about its importance on our economy.

The Fed literally keeps the United States economy up and running, ensuring banks have sufficient funds on hand to satisfy withdrawals and, conversely, balancing excess funds for deposits. As an undergraduate student at Sonoma State University in Northern California, I was fortunate enough to tour the San Francisco Federal Reserve branch and it was an eye-opening experience.

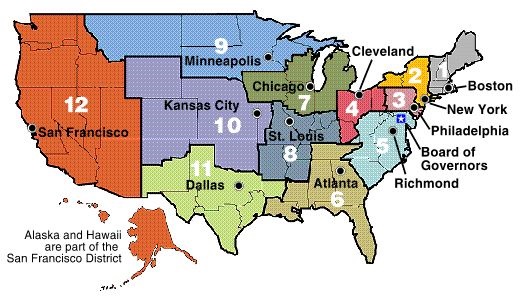

My economics professor casually asked our class one day if we would be interested in touring the Federal Reserve. Having studied how the economy functions and how money gets processed, saying yes to the tour was a no-brainer. Touring a government building like the Federal Reserve is not as simple as walking up to the entrance and saying please. With 12 regional branches across the country, each processes its region’s plethora of payments every single day:

Tour Approval: Vault-Like Security

The tour approval process starts with security measures more advanced than TSA airport screening.

Not only does the Federal Reserve building have metal detectors on-site, but the group’s attendee list must be submitted two weeks in advance so a background check may be performed on each individual before he or she is approved. If that’s not enough, each tour attendee is on camera from the second he or she approaches the front entrance until the moment he or she leaves. Upon entering, each tour guest surrenders all cameras, including smart phones, to a secured holding area. Next, attendees are given a stickered badge to be worn near the shoulder. Once a guest steps outside after the tour, the sunlight-activated badge “expires,” to prevent re-entry and unauthorized access to the building.

First Stop… Cash ‘n Checks!

The on-site tour begins with a guide taking guests downstairs to view the cash area, which contains three components: shipping and receiving, the vault, and high speed processing. Close by is the check processing line where tour guests are educated on checks’ numerous security features while viewing thousands of checks whizzing by them. Next to the check processing line is a room with crates stacked full of $20 bills totaling millions upon millions of dollars. A jaw dropping moment for anyone, especially college students!

$75 Million Shredded

During the 90-minute tour, a guide provides the group with the history of the Federal Reserve System, cash, checks, counterfeit bills, and much more. For instance, at the time of the tour, the San Francisco Federal Reserve branch by itself shredded $75 million in counterfeit bills every day! This shredded money is replaced with brand new money printed and distributed from the Bureau of Engraving and Printing. There is ongoing research and development into security enhancements to make counterfeiting more difficult. Take a look at the new $100 bill below, released to the public in October 2013. The two largest differences are the blue stripe and the copper colored Liberty Bell, both having features inside them that shift depending on the angle of the bill:

Here are some interesting tidbits shared on the tour:

- Of the twelve Federal Reserve Districts, the Twelfth District (San Francisco) is the largest, covering about 1.3 million square miles, or 35 percent of the nation’s area.

- San Francisco’s branch processed 18.4 billion currency notes in 2012, which is about 73.3 million notes per day. (Nearly 85,000 notes processed per second.)

- The largest note ever printed is $100,000 but was only used for transactions among Federal Reserve branches, not for public use.

The Money Museum!

The second to last stop on the tour is an exhibit hall with half-inch thick locked glass showing the progression of each cash denomination’s design and security enhancements throughout history. In the same room stands a case full of state quarters, all in mint condition. The final tour stop is the building’s foyer, containing a case full of shredded counterfeit bills. And as a parting gift, the tour guide gave attendees a baggy full of shredded counterfeit money to take home!

Request a free tour of the San Francisco branch here. For information on other Federal Reserve branch tours, visit Federal Reserve Education. Unfortunately, not all branches grant public tours. Space is limited and priority is given to high school and college students, educators, and the business community. Plan ahead, it’s well worth it even if you are not really interested in currency or how the financial system operates.

Deciding on which payment types to accept at your business does not have to be as background-dependent as a visit to the Federal Reserve. We’ve already performed all of the necessary background checks to help you in deciding which payment types are best. Download our newest guide below to learn the six most in-demand payment types that your business should include in order to be customer friendly, save time and money, and generate maximum revenue.