The Federal Reserve released its latest payment trend findings, some of which may come as no surprise. A variety of mobile payment solutions are quickly being adopted by consumers. But, if you think check payments are slowly becoming obsolete, think again. The 2013 Federal Reserve Payments Study states, “An estimated 18.3 billion checks were processed in 2012, with a value of $26.0 trillion.” With smart phones’ capabilities and technology continuing to improve, there’s no denying mobile payments and ACH transactions are increasingly popular, but checks continue to be in high demand.

The Federal Reserve released its latest payment trend findings, some of which may come as no surprise. A variety of mobile payment solutions are quickly being adopted by consumers. But, if you think check payments are slowly becoming obsolete, think again. The 2013 Federal Reserve Payments Study states, “An estimated 18.3 billion checks were processed in 2012, with a value of $26.0 trillion.” With smart phones’ capabilities and technology continuing to improve, there’s no denying mobile payments and ACH transactions are increasingly popular, but checks continue to be in high demand.

According to the study, “The average value of checks returned unpaid increased from $1,001 in 2009 to $1,222 in 2012.” A rise in average check value brings risk, which is why it is increasingly important to implement a check protection service, to stop questionable checks in their tracks. Even with mobile payments, debit, and credit on the rise, there are some items that plastic payment methods are not typically used for, like cars.

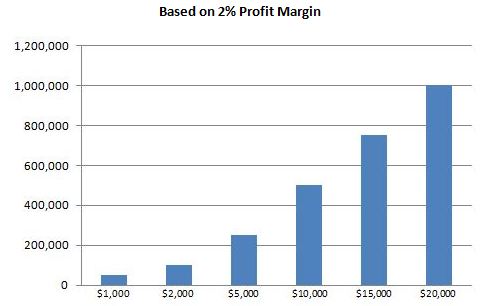

Take the 2012 average value of checks returned: $1,222. If your business operates on a 2% profit level, you would need to sell in excess of $61,000 just to make up for one $1,222 bad check! To an auto dealer, that $61,000 is potentially two new car sales just for one bad check, down the drain. As the chart here shows, these values grow exponentially the more bad checks your business accumulates. For example, at a 2% profit margin, $5,000 in bad checks would require just over $200,000 in new sales to compensate for this loss:

For some businesses, determining the difference between a check verification and check guarantee service can be a game-changing decision. As a check service provider, one of the most common questions we get asked is:

“What’s the difference between check verification and check guarantee?”

The two services can be beneficial to businesses because they help mitigate risk and increase sales. Although they share some qualities, there are some fundamental differences in how they operate. Some important questions to ask yourself when deciding between the two are:

- Does my business sell high or low-ticket items?

- What is my profit margin?

- On average, how many check payments do I receive each month?

Your answers can help you narrow down which check service is right for your business.

Few things in life are completely free, and even fewer are guaranteed. Contrary to popular belief, death and taxes are not even among the guaranteed things. Check payments can be guaranteed, and they can potentially bring you to new sales levels and separate you from the competition.

Think of check verification as advice because the check service provider will either recommend or not recommend merchants accept a check. Check guarantee is more of a premium service, as it will help prevent merchants from payment loss by reimbursing the merchant the appropriate funds should a check bounce.