Let’s flashback for a minute to Q4 of 2014. The car hauler just unloaded the 2015 models from the factory, you washed and waxed, and proudly displayed them on your showroom floor. You advertised on TV and radio announcing the vehicle’s latest features, improved safety handling, and best-in-class customer satisfaction ratings.

Now consider this: A married couple with two kids saw your commercial during their favorite singing competition and discussed how nice the new 2015 model looked – with an attractive price to go along with it. The couple wanted to purchase, but couldn’t make the necessary down payment because they knew holiday shopping was coming very quickly.

Fast forward to present day, when their holiday shopping is over – and your holiday might begin, especially since nearly 8 out of 10 taxpayers will receive refunds, and if this couple is one of them, it’s pretty likely they’ll bring it to you.

Besides Bills …

The most common thing taxpayers spend their refund checks on is big-ticket purchases, such as – you guessed it – buying a new vehicle. And of those consumers who receive a refund, 1 out of 6 are likely to buy a car. The two biggest groups most likely to spend their refunds on a new car are Millennials -- young adults under 35 years old -- and parents, at 29 and 26 percent, respectively.

The average life of U.S. vehicles on the roadways reached a record high last year of 11.4 years. Of course, many of the drivers who hold onto their cars longer may not be able to afford a new set of wheels or have easy access to credit. Yet, there comes a point when auto repairs become too costly for the vehicle’s value. This is where tax refunds are the under-recognized, highly appreciated variable in your vehicle turnover rate.

Renting is Still Attractive

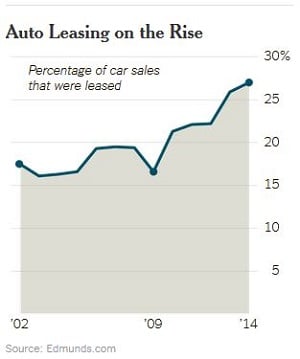

Leasing is not immune to tax refunds. The average length of an auto lease fell to about 36 months in 2014 – the shortest term ever recorded for the metric. Auto industry experts believe the increasing turnover rate for leases is in large part due to technological advances in vehicles complete with Bluetooth, parking assist, touch screen, and push-button ignition. This new “smartphone on wheels” concept is certainly a draw for consumers to upgrade. Monthly payment schedules are the norm for many things, including vehicles, especially since auto dealers focus intently on vehicle monthly payments, not the total price when speaking to buyers.

Using the 36 months as the baseline, technology in 2018 will likely have changed radically and it is a great time for consumers to return their lease. Technology advancements have helped contribute to the fact that more than one out of four vehicles in 2014 were rented, not bought. The moral of the story, if consumers don’t buy, leasing is a great alternative for tax refund payments.

Using the 36 months as the baseline, technology in 2018 will likely have changed radically and it is a great time for consumers to return their lease. Technology advancements have helped contribute to the fact that more than one out of four vehicles in 2014 were rented, not bought. The moral of the story, if consumers don’t buy, leasing is a great alternative for tax refund payments.

One Forgotten Piece

Don’t forget the value of trade-ins considering there is a 50-50 chance consumers will trade-in their current set of wheels when buying or leasing. Consumer Reports recommends buyers place at least 20 percent down on vehicle purchases. With the average transaction price for cars and light trucks at $32,386, that 20% down payment equates to $6,477. Now granted, this year’s $3,539 average tax refund will not cover 20% of this transaction price. But for the vast amount of vehicles where the average refund does not cover the recommended down payment percentage, their trade-in value can help put them over the top.

Just because April 15th is the official tax deadline don’t sweat if car buyers are not packing your dealership the days leading up to the deadline. Refund checks can take 4-6 weeks to be issued, and upwards of 7 weeks this year. Even if the average refund may not cover the total cost of a down payment, tax refunds provide a huge assist in allowing car buyers to drive off your lot on four new wheels.

Multiple Check payment service is an alternative down payment option and complementary assist as well. With Multiple Check, consumers can spread out their down payment over four scheduled payments. You simply approve the checks at your point of sale on day one, agree on a payment schedule with the car buyer for the remaining three checks, and all funds are guaranteed to you. This option can even open up a new revenue stream for your dealership because consumers with bad credit ratings have a better chance of driving off in a 2015 model. You’ve now maximized your sales, and car buyers drive home their shiny new vehicle.

Turn tax refunds into a higher vehicle turnover rate with Multiple Check payment service.